October 20, 2025 • 5 min read

Aviation can’t reach net zero without ethanol-to-jet: the time to scale is now for the U.S. Midwest

Azadeh Siadat Rohani, Senior Technical Consultant in Process Technology at Worley Consulting, explores how scaling ethanol-to-jet solutions can drive aviation’s net-zero transition.

Aviation fuels economies, connects people, and underpins global trade. But it also carries a climate burden that can no longer be ignored. The sector has set ambitious goals: net zero by 2050, supported by most major airlines covering more than 80% of global air traffic.1 Yet despite the pledges, progress is lagging far behind what’s needed.

The scale of the gap

By 2025, announced projects are expected to deliver around 660 million gallons of sustainable aviation fuel (SAF). In isolation, that looks like a milestone. In context, it represents less than 1% of the 94 billion gallons of jet fuel consumed annually.2 The distance between ambition and delivery is widening, not narrowing.

If aviation is to remain viable in a low-carbon world, production of SAF must accelerate dramatically. This is not a future challenge – it’s a now challenge.

A moment shaped by policy

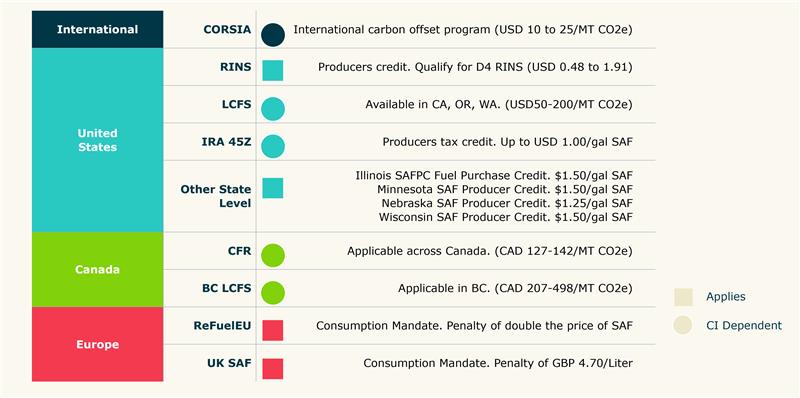

In the United States, recent legislation has reshaped the investment case for SAF. The regulations are changed quite often and need to be monitored constantly. The budget reconciliation bill (OBBBA) was signed into law on July 4, 2025 which secures and extends vital incentives:

- 45Z clean fuel production credits through 2031.

- SAF-specific tax credits that reward projects based on their carbon intensity.

- Exclusion of indirect land use penalties, improving certainty for corn‑based ethanol-to-jet (ETJ) pathways.

These measures build on established mechanisms like D4 RINs and regional programs, making the Midwest one of the most attractive global hubs for SAF investment. For producers and investors, this alignment of policy and market demand is rare. The window to scale production has never been clearer.

Why ethanol-to-jet matters

Feedstock availability is the bottleneck most SAF producers face. Waste oils and fats, while valuable, are limited in supply. Scaling aviation fuel production will require additional, higher-yield pathways.

“When comparing soybean oil, the main HEFA feedstock, to corn, the SAF yield per acre of corn is five to six times greater than the SAF yield from an acre of soybeans.”

As we’ve previously explored in our article, Can the alcohol to jet pathway solve the growing sustainable aviation fuel demand challenge?, the pathway is not without challenges. But with continued U.S. policy support and advances in carbon intensity reduction, those hurdles are increasingly surmountable.

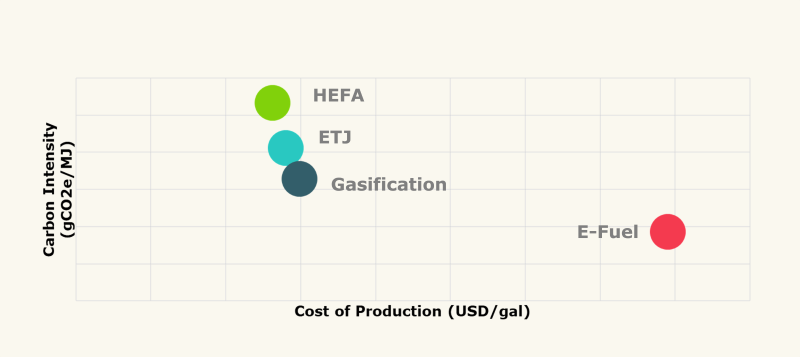

Economics for ethanol-to-jet are promising with cost of production landing only slightly higher than HEFA. And with current U.S. policy environment encouraging renewable diesel production for HEFA plants, the ETJ pathway is becoming an increasingly viable option to dominate SAF production. But profitability will depend on how effectively projects integrate efficiency measures and carbon intensity reductions.

The real challenge now is scaling responsibly, delivering projects that meet demand while maintaining credibility on emissions.

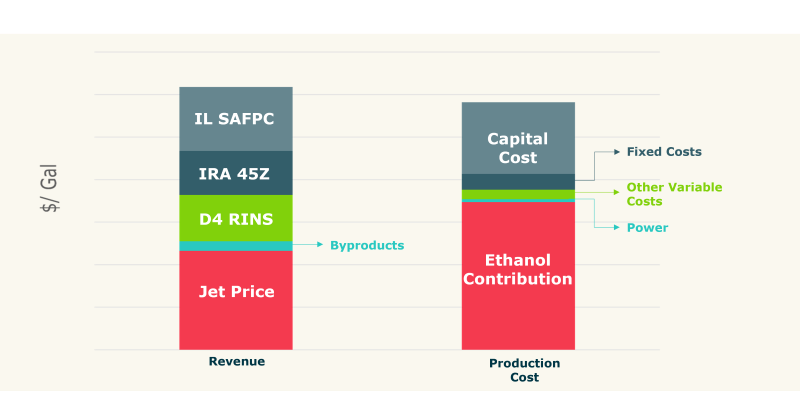

In one analysis, the cost of production comes to $5.80, while the potential revenue, including incentives, is $6.20. “The numbers support profitability and competitiveness of the ethanol-to-jet pathway, which gives us some comfort about investing in this process,” she says. Looking at the cost of production for ETJ, ethanol feedstock is the largest component, followed by capital cost. “Revenue projections,” Rohani says, “indicate ETJ can be profitable, but only if incentives are added to the jet and byproducts revenues.” (See Figure-3, above.)

Reducing carbon intensity: the differentiator

ETJ, however, will only be profitable if the ethanol feedstock and ETJ process meet the carbon reduction thresholds prescribed in the various incentive programs. “ETJ compares favorably to HEFA in terms of carbon intensity reduction,” Rohani says.

Financial incentives are tied directly to carbon intensity (CI) scores. In practice, this means every link in the value chain matters:

- Agriculture: Sustainable farming practices that lower fertilizer use and improve soil health.

- Production: Integration of renewable power and heat recovery to cut energy consumption.

- Carbon capture: Applying carbon capture and storage (CCS) to production facilities to reduce lifecycle emissions.

- Integration: Co-locating with existing ethanol infrastructure to reduce capital costs.

“Those solutions are really dependent on a specific case,” Rohani says. Carbon capture and sequestration of the CO2 from fermenters offers the biggest opportunity for CI reduction – around 30%. Integrating CCS with cogeneration offers another 20-30% reduction. Using low-carbon hydrogen, low-carbon power and capturing carbon in the ETJ process itself offer smaller CI reductions.

“The steps you take to reduce carbon intensity gives you higher credits per gallon.”

Projects that embed CI reduction strategies from the start will not only capture higher credits but also deliver credible emissions savings that are critical for airlines under scrutiny from regulators, customers and investors alike.

Beyond compliance: economic and social value

Scaling SAF production is not just about enabling a reduction of emissions and contributing to cleaner skies. It carries economic and social value as well.

For Midwestern communities, investment in ETJ facilities means construction activity, long-term operations, and new opportunities for farmers supplying the feedstock. For airlines, SAF offers supply security and a hedge against volatile fossil fuel prices. For society, it ensures aviation retains its license to operate while decarbonizing the world.

The benefits are real, but they will only materialize if the industry seizes the moment to build and integrate at scale.

Partnering for delivery

Transitioning aviation to a sustainable footing cannot be done by one stakeholder alone. Farmers, refiners, technology providers, airlines, regulators, and investors all have a role to play.

Success depends on collaboration and on partners who can navigate both the technical and policy dimensions of SAF.

This is where we bring distinct value. With decades of experience in energy, chemicals, and resources, combined with deep capability in lower-carbon fuels, we work beside our customers to deliver projects that cut carbon intensity, optimize integration, and scale with confidence.

The choice ahead

The aviation industry has set its sights on net zero. But targets without delivery are not enough. The gap between supply and demand for SAF is stark, and closing it will take urgency, investment and technical expertise.

The market conditions are here: strong policy, clear economics, and proven pathways like ethanol-to-jet. The projects that move forward now will define the trajectory of aviation’s sustainable future.

The question is no longer whether SAF can scale. The question is who will lead in building the capacity the world urgently needs.

Key takeaways

- Scaling SAF is urgent: Current production meets only a fraction of aviation’s net-zero needs – action is needed now, not later.

- Ethanol-to-Jet (ETJ) is a viable solution: Corn-based ETJ offers higher fuel yields and is economically competitive, especially with U.S. policy incentives.

- Carbon intensity is critical: Projects must integrate carbon reduction strategies (like carbon capture and renewable energy) to qualify for incentives and ensure credibility.

- Midwest is primed for growth: Favorable legislation and feedstock availability make it a global hub for SAF investment.

- Collaboration is key: Success depends on partnerships across the value chain – from farmers to airlines to regulators.